prince william county real estate tax assessment

Comments may be made by telephone at 804 722-8629 or via e-mail to assessorprincegeorgecountyvagov. Property Taxes No Mortgage 62141700.

Property Taxes Mortgage 346595000.

. Effective tax rate Prince William County 00105 of Asessed Home Value Virginia 00082 of Asessed Home Value National 00114 of Asessed Home Value Median real estate taxes paid Prince William County 4010 Virginia 2234 National 2471 Median home value Prince William County 382400 Virginia 273100 National 217500 Median income. In Prince William County Virginia the tax rate is 105 which is substantially above the state average. If you are searching by sale date please enter it in the following format.

Than 6 characters add leading zeros to it before searching. 703 792 6780 Phone The Prince William County Tax Assessors Office is located in Prince William Virginia. By mail to PO BOX 1600 Merrifield VA 22116.

Checking the Prince William County. While the Office of Real Estate Assessor has attempted to ensure that the data contained in this file is accurate and reflects current property characteristics the County of Prince George makes no warranties expressed or implied concerning. Request a Filing Extension.

Information on your propertys tax assessment. Appealing your property tax appraisal. Enter street name without street direction NSEW or suffix StDrAvetc.

Ad Find Out the Market Value of Any Property and Past Sale Prices. Get driving directions to this office Prince William County Assessors Office Services. If your account numberRPC has less.

Submit Business Tangible Property Return. Enter jurisdiction code 1036. However we can assist you in linking your real estate account.

Prince William County - Log in. If you are searching by gpin please enter it in the following format. If your real estate account does not show on the My Accounts screen it is because real estate account types generally do not automatically link when registering.

All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually by the Real Estate Assessments Office. The Assessments Office mailed the 2022 assessment notices beginning March 14 2022. Submit Daily Rental Return.

Reporting upgrades or improvements. Prince William County Property Tax Collections Total Prince William County Virginia. Prince William County real estate taxes for the first half of 2020 are due on July 15 2020.

Quarterly Project Report View status of current major County projects. 300000 100 x 12075 362250. If you assume tobacco was 2d per pound then the tax rate in Prince William County would be.

These buyers bid for an interest rate on the taxes owed and the right. Enter your payment card information. By creating an account you will have access to balance and account information notifications etc.

There are several convenient ways property owners may make payments. Advance payments are held as a credit on your real estate personal property or business tax account and applied to a future tax bill when the tax rate and assessment are set or when you file your business tax return. You can pay a bill without logging in using this screen.

Enter the house or property number. If you have questions about this site please email the Real Estate Assessments Office. Report High Mileage for a Vehicle.

What is different for each county and state is the property tax rate. Submit Consumer Utility Return. Please contact us at.

You may view the 2022 assessments via the online Real Estate Property Assessment System. Report a Vehicle SoldMovedDisposed. Account numbersRPCs must have 6 characters.

Property Assessments Real Estate Information View and print real property assessment information. Enter the Account Number listed on the billing statement. For additional eligibility criteria please contact the Real Estate Assessments Office at 703-792-6780.

Prince William County VA currently has 479 tax liens available as of April 27. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. Step-by-step instructions are displayed from the website.

Prince William County Virginia Home. This estimation determines how much youll pay. Prince William County Real Estate Assessor 4379 Ridgewood Center Drive Suite 203 Prince William Virginia 22192 Contact Info.

Press 2 to pay Real Estate Tax. Prince William County accepts advance payments from individuals and businesses. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Prince William County VA at tax lien auctions or online distressed asset sales.

1759 - 104 pounds tobacco1250 pounds per annual crop 83 tax rate 1760 -. Submit Consumption Tax Return. By phone at 1-888-272-9829 jurisdiction code 1036.

The tax rate is expressed in dollars per one hundred dollars of assessed value. The real estate tax is paid in two annual installments as shown on the tax calendar. Prince William County collects on average 09 of a propertys assessed fair market value as property tax.

Telephone Payments Have pen and paper at hand. Own and occupy the home as hisher sole dwelling. The Prince William County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Prince William County Virginia.

Use both House Number and House Number High fields when searching for range of house numbers. The Prince William County Police Department is requiring all businesses and residents to register their alarm systems with the department. Press 1 to pay Personal Property Tax.

When tax assessors estimate the value of your property they multiply that number by the tax rate of the county. For example if the total tax rate were 12075 per 100 of assessed value then a property with an assessed value of 300000 dollars is calculated as. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

2022 Tax Relief Brochure. Submit Business License Return. Mmddyyyy mmdd.

You can contact the Prince William County Assessor for. Submit Transient Occupancy Return. Click here to register for an account or here to login if you already have an account.

Dial 1-888-2PAY TAX 1-888-272-9829.

Bland Family Of Stafford Prince William Loudoun Co S Va And Edgefield County Sc Goyen Family Tree

County Employees Summer Jobs Prince William County

Prince William Officials Pumping Brakes On Car Tax Increases Headlines Insidenova Com

The Rural Area In Prince William County

Data Center Opportunity Zone Overlay District Comprehensive Review

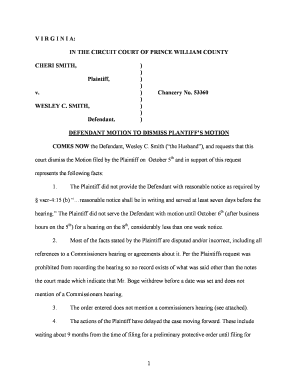

Fillable Online Liamsdad V I R G I N I A In The Circuit Court Of Prince William County Cheri Smith Plaintiff V Liamsdad Fax Email Print Pdffiller

Prince William School Calendar Fill Online Printable Fillable Blank Pdffiller

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Now Accepting Applications Restore Retail Grant Program

Prince William County Park Rangers New On Call Number Effective April 1 2022

Prince William Prosecutors Seek More County Funding Headlines Insidenova Com

Prince William County Warranty Deed Form Virginia Deeds Com

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Prince William Area Leaders Call For Reconsideration Of Route 28 Bypass Headlines Insidenova Com